Randomization

As the cofounder and CEO of a tech startup working to improve financial inclusion in one of the world’s largest countries that is also one of the largest cash economies, I have amassed a wealth of odd knowledge on how cash works. How it works, specifically, at the intersection of people and connectivity. It always excites me so that there is a world of difference in how different places have different assumptions about payments.

My first world assumptions already went out of the window when I spent a year in Myanmar before SIM cards went down in price from $2000 to $1. There, bags of cash were king. Bags of cash under a desk, even better.

Here in Indonesia, we faced the same challenges as most other companies: how do we accept payment from the average person? For our customers to start selling pulsa (airtime), internet packages and other products with Wobe app, we need them to first pay us for their prepaid account. (Here, you can also buy a cigarette by the stick when you want to smoke it, instead of buying an entire pack. The same is true of phones.)

Happily, this is why we do what we do. Before you can improve on something, you first need to know it well.

Not reinventing the wheel

It helps to examine the prevalent norm.

In Indonesia, you commonly see what can be described as “hacks for the cash economy”. These are necessary ‘hacks’ through a set of circumstances entirely unique to Indonesia; with more than 17 000 islands and a sparse population outside of Java, cash is still king here, and will remain so for the foreseeable future. Distribution and reach (of ATMs, banks, etc) is only one part of it.

Other than cash-on-delivery, it is quite common to pay for things online in any of the following ways:

- Asking a friend with a bank account to transfer the payment for you

- Standing in line at a bank, where you do not have an account, to make a manual transfer

- Going to a convenience store to tell them you want to pay for say, a flight ticket; waiting 40 min for their payment system to boot up, then finally making a cash payment

As you can see, large companies have armies of people just staring at internet banking screens to verify each and other transaction in real time.

What has emerged as the de facto way of taking manual cash payments is so unique and elegant, and so characteristically Indonesian: randomized unique codes that almost function as convenience fees, cheaper than credit or debit card percentages.

In many ways, Tokopedia has been at the forefront of Indonesian ecommerce. As one of the pioneers of the 3 digit unique code method, we were impressed at how simple yet effective it was — for both the consumer and the company.

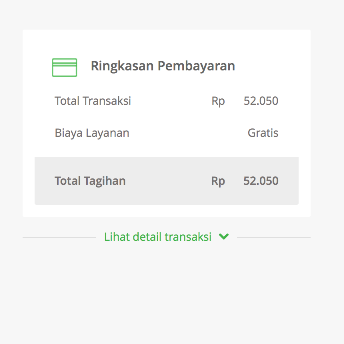

Assuming I want to buy a USB-powered electric fan, or kipas, which costs IDR 52 050 (USD 3.91).

If I were to select the cash / manual bank transfer method, I would see this screen:

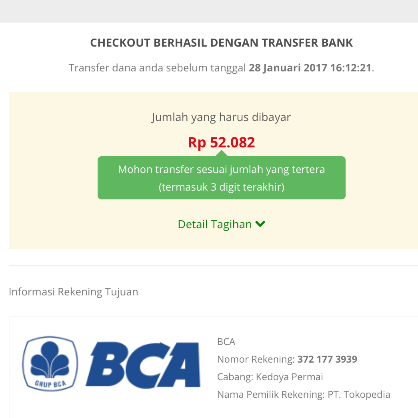

My total, with the unique code (+032) added to the final bill.

My total, with the unique code (+032) added to the final bill.

All Tokopedia would have to do would be to verify that they had indeed received a transfer of IDR 52 082 on that day.

It would not matter from whom, the payment came from, or whether it was successful or pending (manual payments can be seen as pending after a certain time in the afternoon, depending on the bank and only available the next business day—which makes Fridays and weekends particularly difficult). The existence of that exact amount would suffice.

How that inspired us

It would be easy to wish that every market was exactly the same as where you are familiar: but that mentality would not take you far. Anywhere, but specifically in Indonesia.

As a company that has betted its entire future on the 4th most populous country, it has always been in our DNA to operate within the frame of what works here, and to never once claim to know it better.

We believe that the future will be a mix of unique ‘hacks’ like these, along with a substantial push towards the digitization of payments (more on that in a bit).

I’m proud to announce that the next feature we will have in the Wobe app, will be our very own version of the randomized unique code. We are currently testing it but it appears to be a huge improvement to our top-up mechanism. All of our product and business decisions are driven by the simple question: how does this improve the lives of the people we claim to work for? In this case, we will be able to easily take payments from individuals who may live as far as one to five hours away from a bank, an ATM or a convenience store.

What is the way forward?

How does one reconcile the two Indonesias, then: with one foot so violently in the future, with its obsessive love of mobile phones and social networks, and the other so virulently enamoured by the ease of cash?

Short of pushing the country towards bank accounts and debit and credit cards, what looks likely is this: there will be a peaceful coexistence of cash and digital payments. In some ways, Indonesia will lead the way in Next Billion tech, ecommerce and payments. If India’s PayTM and China’s Alipay are any indicators of how a hinterland with a large population and a unique set of infrastructural and geographical challenges are anything to go by, I believe that in 3 years Indonesia will find its own beat. Which is why we do what we do at Wobe: we believe that if we build a product that helps the average person participate in the digital economy, we will be able to find innovative ways to make a difference.

What we do best is to empower women to be the missing link between their communities and the world of online opportunity. Be it in small features, like randomized topups, or in the big ones—like creating financial independence sessions for the women we work with—we are driven by our mission to do well and to do good.

Perhaps one day there will be a new school of thought on product design and enterprise: how to create and design with empathy, as if our lives depended on it.

Our next build will feature the randomized topup feature.